Supported payout countries

Here’s the full list of countries we support:Tax compliance

Dub Partners automatically handles tax compliance for your US-based partners by collecting W-9 forms and sending out 1099-NEC forms to individuals or entities that received $600 or more in payments for a given fiscal year. For non-US partners, Dub collects W-8 forms to confirm they are not a US resident for tax purposes.Payouts dashboard

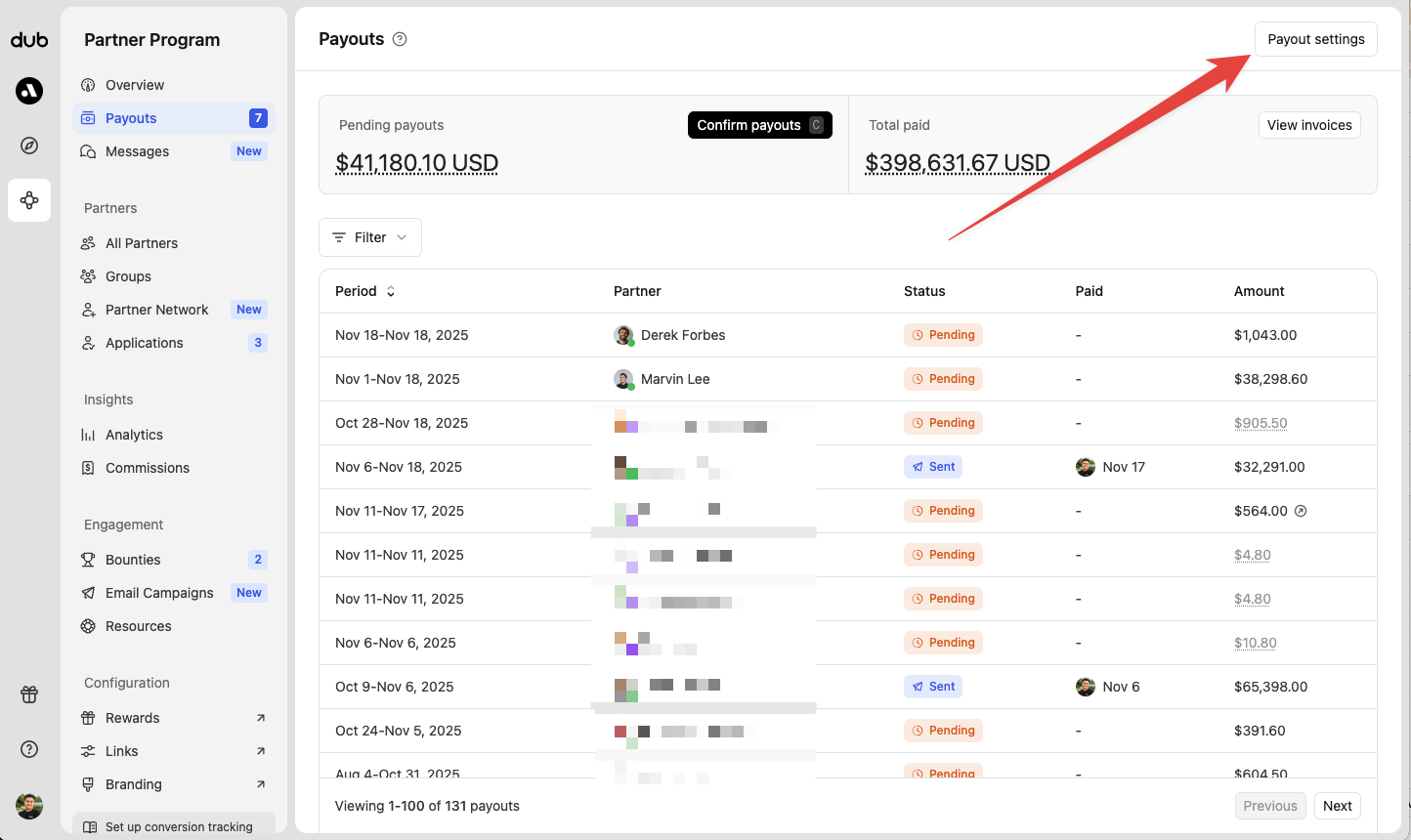

To view your payouts, go to your Partner Program tab and click on the Payouts page.

- Eligible payouts – due commissions for partners that have configured their payout method).

- Ineligible payouts – due commissions for partners that have not configured their payout methods yet).

- Completed payouts - Payouts that have been sent and confirmed

- Processing payouts - Payouts that are in progress (timing may vary based on the selected payout method)

| Column | Description |

|---|---|

| Period | The payout range, starting from the date of the partner’s first commission to the end of the month of their last commission |

| Partner | The partner receiving the payout |

| Status | The current payout status |

| Paid | The date the payout was confirmed, and by whom |

| Amount | The total amount paid to the partner |

Payout statuses

A payout can have one of the following statuses:| Status | Description |

|---|---|

| Pending | Payouts that have not been processed yet, which can either be currently due or remain in pending status (in cases where the partner has not configured their payout method, or the payout has not yet reached the minimum payout amount). |

| Processing | Payouts that have been confirmed – depending on your payout method, this step can take up to 4 business days. |

| Sent | When the funds have been sent to the partner’s connected bank account. |

| Completed | When the payout has been fully paid out to the partner. |

| Failed | This is an edge case that happens with PayPal payouts, where the partner’s PayPal is not set up to receive payouts. No action is required from your end in these cases – the partner will need to sort out their PayPal account and retry the payout from their end. |

| Canceled | For payouts that have been canceled – usually when a partner is banned from the program. |

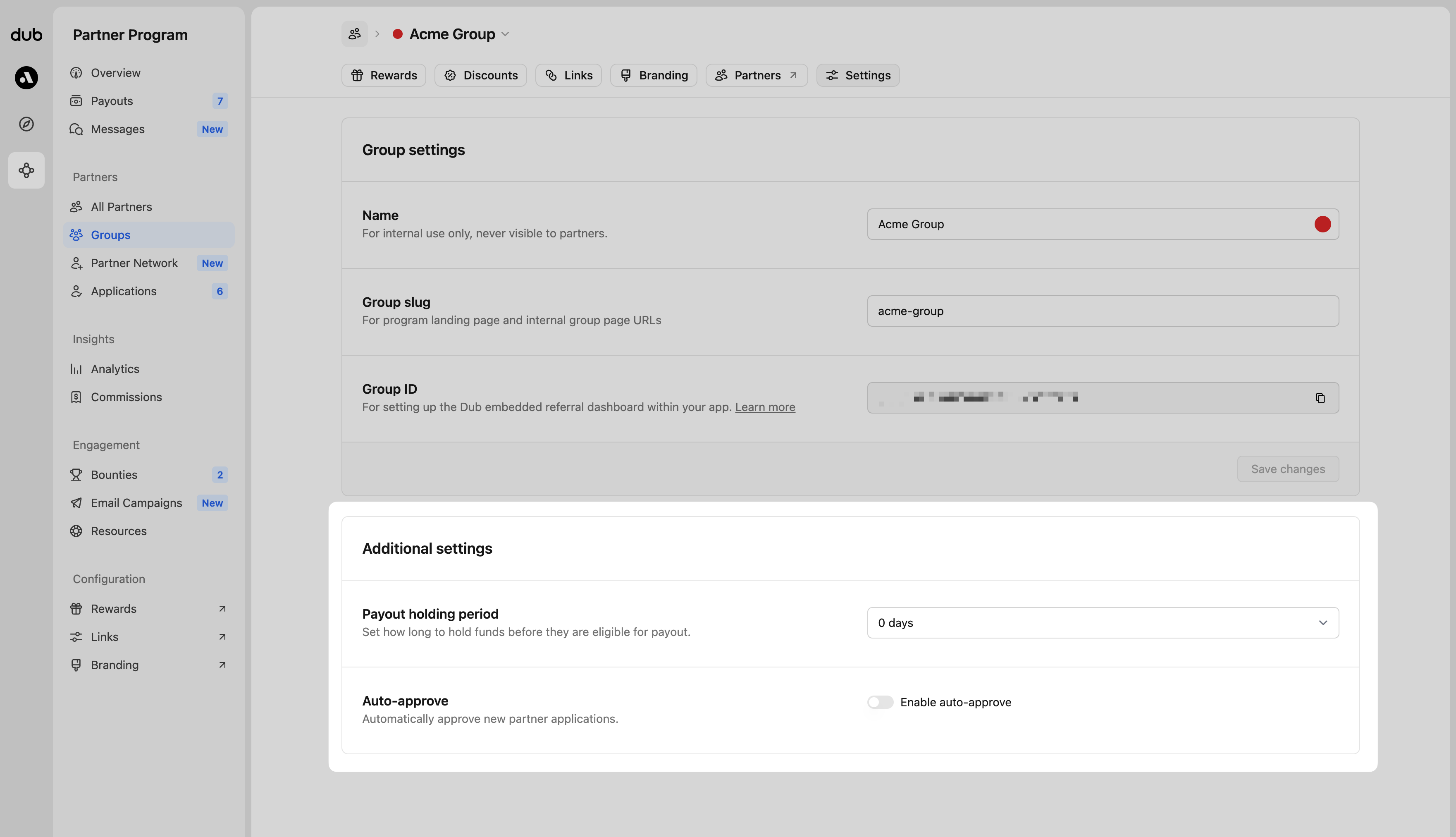

Payout holding period

On Dub, you can also set a “payout holding period” to specify how long your commissions will be held in “pending” status before becoming eligible for payout. This is useful for safeguarding against potential refunds, chargebacks, or fraudulent transactions.If you’re using our Stripe integration, any

refunds that happen on Stripe will be automatically detected by Dub and the

corresponding commission will also be marked as

refunded.

- 0 days (default)

- 7 days

- 14 days

- 30 days

- 60 days

- 90 days

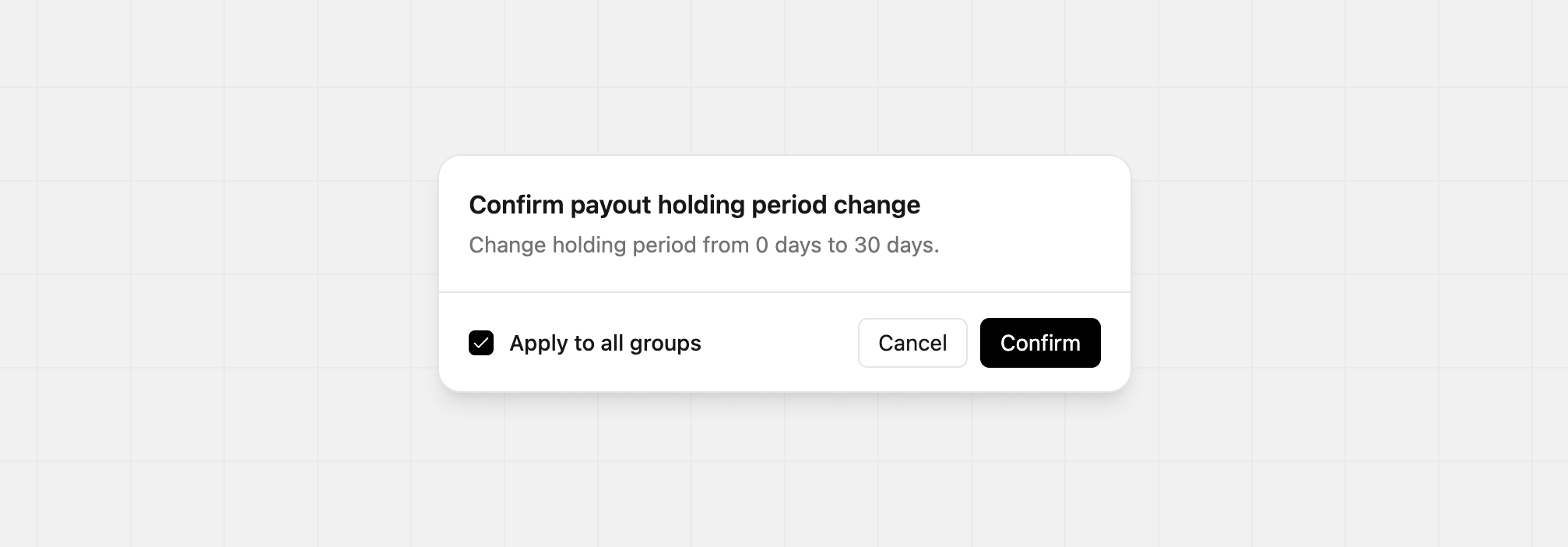

Apply to all groups before confirming. The change will take effect right away.

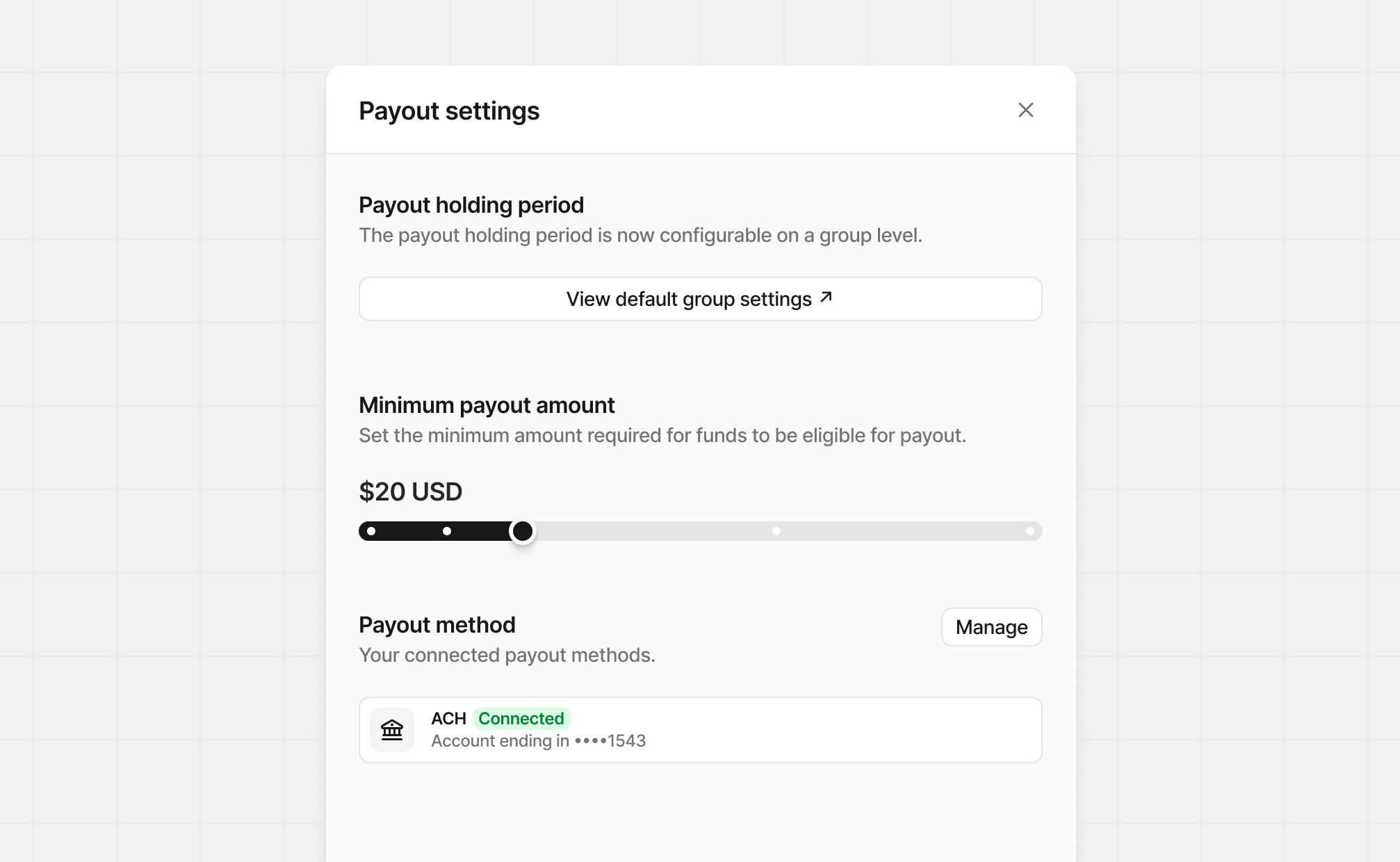

Minimum payout amount

You can also set an optional “minimum payout amount” (e.g. $100). When this is set, partners with earnings below the minimum payout amount won’t be eligible for payout until they reach the specific threshold set. Click the button in the top right to show the Payout settings. Unlike the payout holding period, this setting is program-wide.

- $0 (default)

- $10

- $20

- $50

- $100

How to pay your partners

When one or more of your partners have earned more than the minimum payout amount, click Confirm payouts from the summary header to open the payout details.- Payout method: Choose your payout method based on the accounts you’ve connected. Click the gear icon to manage connected payment methods.

- Cutoff Period: If set, only commissions earned on or before this date will be paid. Useful for reconciliation payouts for a specific fiscal period (e.g. last month, last quarter) without including newer commissions.

Excluding payouts

In some cases, you may want to exclude a partner’s payout from the current batch. To do this, hover over the partner’s row in the payouts table and click Exclude. This removes the partner from the current payout batch.

Payout fees and timing

On Dub, you can send payouts using various payment methods such as ACH, credit card, and more. Depending on your Dub plan and the payment method you choose, your payout fees and timing will vary:| Payment method | Fee | Timing |

|---|---|---|

| ACH | Business / Advanced: 5% Enterprise: 3% | Up to 4 business days |

| Credit card / Link Apple Pay / Google Pay | Business / Advanced: 8% Enterprise: 6% | Instant |